The Benefits and Issues Of Gold IRA Investing

페이지 정보

본문

In recent times, the investment panorama has grow to be increasingly complex and various, with numerous choices accessible to individuals looking to safe their financial future. Among these options, Gold Particular person Retirement Accounts (IRAs) have gained significant popularity as a means of diversifying retirement portfolios. This text will delve into the advantages and concerns of gold IRA investing, offering a complete overview for those involved on this distinctive asset class.

Understanding Gold IRAs

A Gold IRA is a self-directed particular person retirement account that allows investors to carry physical gold, silver, platinum, and palladium as part of their retirement financial savings. Not like conventional IRAs, which typically include stocks, retirement investments in precious metals bonds, and mutual funds, Gold IRAs allow individuals to spend money on tangible property. The allure of gold as an funding stems from its historical significance as a store of value and its means to hedge towards inflation and economic uncertainty.

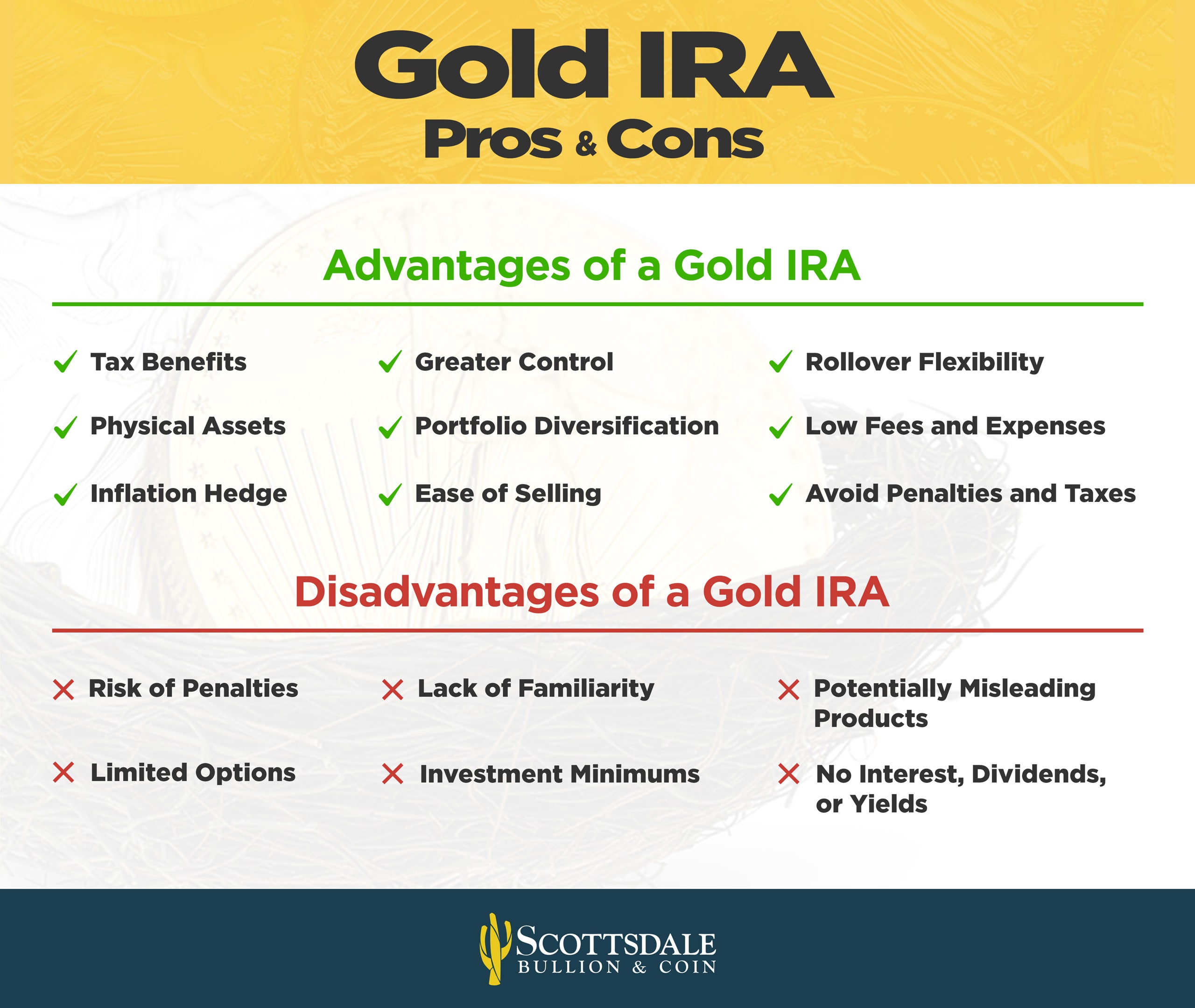

The benefits of Gold IRA Investing

- Inflation Hedge: Considered one of the first causes investors turn to gold is its fame as a hedge in opposition to inflation. Traditionally, gold has maintained its worth over time, even during periods of economic turmoil. As inflation erodes the buying energy of fiat currencies, gold typically appreciates, offering a safeguard for investors' wealth.

- Diversification: A effectively-diversified portfolio is important for mitigating threat. Gold IRAs offer a singular opportunity to diversify beyond conventional asset classes. By together with gold in their retirement portfolios, buyers can cut back their total threat publicity, as gold typically behaves in a different way than stocks and bonds.

- Protection Against Market Volatility: Monetary markets could be unpredictable, with inventory costs fluctuating due to varied elements, including economic indicators, geopolitical occasions, and market sentiment. Gold, then again, tends to maintain its worth throughout market downturns, serving as a protected haven for traders seeking stability.

- Tax Advantages: Gold IRAs offer the identical tax benefits as conventional IRAs. In case you have virtually any queries regarding where by and also tips on how to use retirement investments in precious metals, you can e-mail us in our web site. Contributions could also be tax-deductible, and the investment can develop tax-deferred till withdrawal. This can lead to vital tax savings for buyers trying to construct their retirement nest egg.

- Tangible Asset: In contrast to stocks or bonds, gold is a tangible asset that investors can bodily hold. This could present a way of security for many who choose to spend money on something they will see and contact. Moreover, retirement investments in precious metals in occasions of financial crisis, tangible property like gold may offer more stability than digital or retirement investments in precious metals paper assets.

- Global Demand: Gold has a universal enchantment and is wanted across the globe. Its intrinsic value is acknowledged in numerous cultures, making it a liquid asset that may be simply bought or offered. This world demand may help maintain the worth of gold over time.

Considerations When Investing in Gold IRAs

Whereas gold IRAs present numerous advantages, there are also vital concerns that potential traders should keep in thoughts:

- Regulatory Requirements: Gold IRAs are topic to specific regulations set forth by the inner Revenue Service (IRS). Buyers should be certain that their gold investments meet IRS requirements for purity, which typically requires that gold coins or bullion have a minimal fineness of 99.5%. Moreover, the gold should be stored in an approved depository, which might involve additional charges.

- Storage and Insurance Prices: Holding bodily gold comes with associated costs. Investors must consider the expenses associated to secure storage and insurance for his or her gold holdings. These prices can eat into potential returns, so it is essential to factor them into the general investment strategy.

- Market Fluctuations: Whereas gold is often considered as a stable funding, its value can still be unstable in the short time period. Buyers must be prepared for fluctuations out there and perceive that gold prices might be influenced by numerous components, together with changes in curiosity charges, forex values, and geopolitical events.

- Restricted Development Potential: In contrast to stocks, which may present dividends and capital appreciation, gold doesn't generate revenue. Traders should bear in mind that the primary value of gold lies in its capability to preserve wealth relatively than generate it. This means that whereas gold is usually a invaluable a part of a diversified portfolio, it shouldn't be the only focus of an funding technique.

- Liquidity Considerations: Though gold is generally thought-about a liquid asset, selling physical gold can typically be extra sophisticated than liquidating stocks or bonds. Buyers should remember of the potential challenges in promoting their gold holdings and may must seek out respected sellers to ensure they receive fair market value.

Conclusion

Gold IRA investing presents a singular alternative for people trying to diversify their retirement portfolios and protect their wealth against inflation and economic uncertainty. Whereas there are quite a few advantages to investing in gold, it is crucial for potential investors to think about the related prices, regulatory necessities, and market dynamics. By carefully weighing these factors and retirement investments in precious metals developing a well-rounded investment technique, people can harness the potential of gold as a useful asset of their retirement planning. As with any investment, it's advisable to seek the advice of with a monetary advisor to ensure that gold IRAs align with one's total financial goals and threat tolerance. In doing so, investors could make knowledgeable decisions that contribute to a safe and prosperous retirement.

- 이전글Investing in Precious Metals: A Case Research on Gold And Silver IRA Companies 25.08.08

- 다음글Play m98 Casino site Online in Thailand 25.08.08

댓글목록

등록된 댓글이 없습니다.