No Credit Check Loans: Identical Day Online Options For Rapid Monetary…

페이지 정보

본문

In today’s quick-paced world, monetary emergencies can come up at any moment. Whether or not it’s an unexpected medical invoice, a automotive restore, or a sudden job loss, having immediate access to cash could be essential. For a lot of people, traditional lending options may not be feasible as a consequence of poor credit score history or lack of credit history altogether. That is where no credit check loans come into play, providing a lifeline to these in urgent need of funds.

Understanding No Credit Check Loans

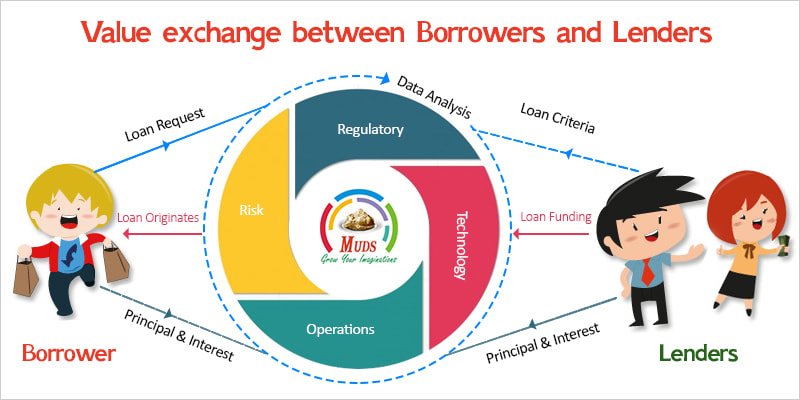

No credit check loans are a kind of brief-term financing that enables borrowers to obtain funds with out undergoing a standard credit score check. These loans are often accessible on-line, making the applying process fast and convenient. Lenders who offer these loans sometimes deal with different elements, resembling income and employment status, moderately than the borrower’s credit score.

The Attraction of Similar Day On-line Loans

The first benefit of no credit check loans is the speed at which funds will be accessed. Many lenders advertise identical-day approval and funding, real payday loans no credit checks meaning that borrowers can obtain cash inside hours of applying. This is particularly interesting for people dealing with pressing financial needs, as it eliminates the prolonged ready intervals related to conventional loans.

How to use for No Credit Check Loans

Making use of for a no credit check loan is generally a straightforward process. Most lenders have online platforms where borrowers can fill out an application type. The necessities may range by lender, however frequent criteria include:

- Proof of Income: Borrowers should reveal a gentle revenue to qualify for a loan. This will include pay stubs, bank statements, or tax returns.

- Identification: A government-issued ID is often required to confirm the borrower’s id.

- Checking account: Many lenders require borrowers to have an active bank account for the deposit of funds.

Professionals and Cons of No Credit Check Loans

Like several monetary product, no credit check loans include their very own set of advantages and disadvantages.

Professionals:

- Accessibility: These loans are accessible to people with poor or no credit historical past, making them a viable choice for many.

- Velocity: The quick approval and funding process helps borrowers address urgent monetary needs without delay.

- Minimal Documentation: The applying course of is often less stringent than traditional loans, requiring less documentation.

Cons:

- Excessive Interest Rates: No credit check loans often include considerably greater curiosity charges in comparison with traditional loans, which may lead to a cycle of debt if not managed correctly.

- Brief Repayment Terms: These loans usually have brief repayment periods, which may be difficult for borrowers to fulfill.

- Threat of Predatory Lending: Some lenders could engage in predatory practices, charging exorbitant charges and interest rates. If you want to find out more information on real payday loans no credit checks look at our own web-page. It’s crucial for borrowers to research lenders completely earlier than committing.

Suggestions for Borrowers

If you’re considering a no credit check loan, here are some suggestions to ensure you make an informed resolution:

- Store Round: Don’t settle for the primary lender you discover. Examine totally different lenders to find one of the best terms and curiosity rates.

- Read the High-quality Print: All the time read the loan settlement completely to understand the terms, charges, and repayment schedule.

- Borrow Responsibly: Solely borrow what you'll be able to afford to repay. Consider your budget and different financial obligations earlier than taking on new debt.

- Look for Alternate options: If doable, explore different choices resembling personal loans from credit unions, peer-to-peer lending, or help from household and buddies.

Conclusion

No credit check loans generally is a invaluable resource for individuals facing quick financial challenges. Their accessibility and speed make them a sexy choice for these with poor real payday loans no credit checks credit histories. However, borrowers should approach these loans with warning, understanding the potential risks and making certain they're making informed monetary choices. By doing so, individuals can leverage no credit check loans to navigate their financial emergencies while avoiding the pitfalls of high-curiosity debt.

In a world where monetary safety is increasingly uncertain, no credit check loans supply a solution for many. As long as borrowers are diligent and responsible, these loans can provide the required help throughout robust instances.

- 이전글Exploring Easy Loans With No Credit Check: A Case Study 25.07.10

- 다음글시알리스 구매 후기: 효과와 경험 공유 - 일품약국 25.07.10

댓글목록

등록된 댓글이 없습니다.